BARB, Origin & cross-platform measurement

What does BARB think of ISBA’s new cross-media measurement initiative, and how will the audience research body’s progress in measuring the viewing of online video affect the future of the project? CEO Justin Sampson explains

The latest entrant to the UK media measurement scene – Origin Media Measurement – is naturally attracting attention. Inspired by the World Federation of Advertisers’ principles for cross-media measurement, ISBA’s Origin aims to create a common measurement approach across digital platforms and between these platforms and television.

Before saying anything else, BARB is absolutely aligned with the WFA principles. Here are just a few we agree on.

We’re independently run – by the industry and for the industry – with funding and governance that includes buy-side and sell-side partners.

We put in place consistent audience building blocks that allow comparable evaluation of media, and our industry-agreed methodology doesn’t prejudice or discriminate for or against any media service.

Importantly, our data also support the measurement of brand and sales outcomes.

We also get the objective. BARB has delivered unduplicated, cross-platform reporting since audiences started to fragment across distribution platforms in the late 80s and early 90s. Reporting online viewing is something we’ve made great strides on, and we can now start to share preliminary data for SVOD and video-sharing platforms.

One catalyst for the WFA’s initiative – and therefore Origin – is the famous speech given by Marc Pritchard of P&G in January 2017. He called for a level playing field in measurement standards, likening the current position to each American Football team having a different standard of yards needed to gain a first down.

Later that year, Keith Weed of Unilever gave another perspective on the importance of standards. Launching the three Vs of viewability, verification and value, he was adamant that 100% of pixels must be in view. After all, Unilever can’t get away with selling a half-full tub of Ben & Jerry’s.

Marc and Keith both articulated the need for apples-with-apples evaluation. And this is why the industry needs measurement systems with consistent definitions and audience units applied to reported media services. Meeting this need through the delivery of comparable viewing data is what BARB does.

And we naturally understand how audience behaviour evolves. This is why we continuously adapt our services to maintain our provision of always-on insight into how people are watching programmes and associated commercial activity.

Building on my earlier point, BARB has been focussed on measuring audiences to online services. Having mastered the measurement of BVOD services, we are now making good progress in measuring SVOD and video-sharing platforms.

This has taken longer than we’d like, mainly as we have to make sure we get it right. But also because SVOD and video-sharing platforms haven’t yet agreed to participate in our independent measurement of what people watch.

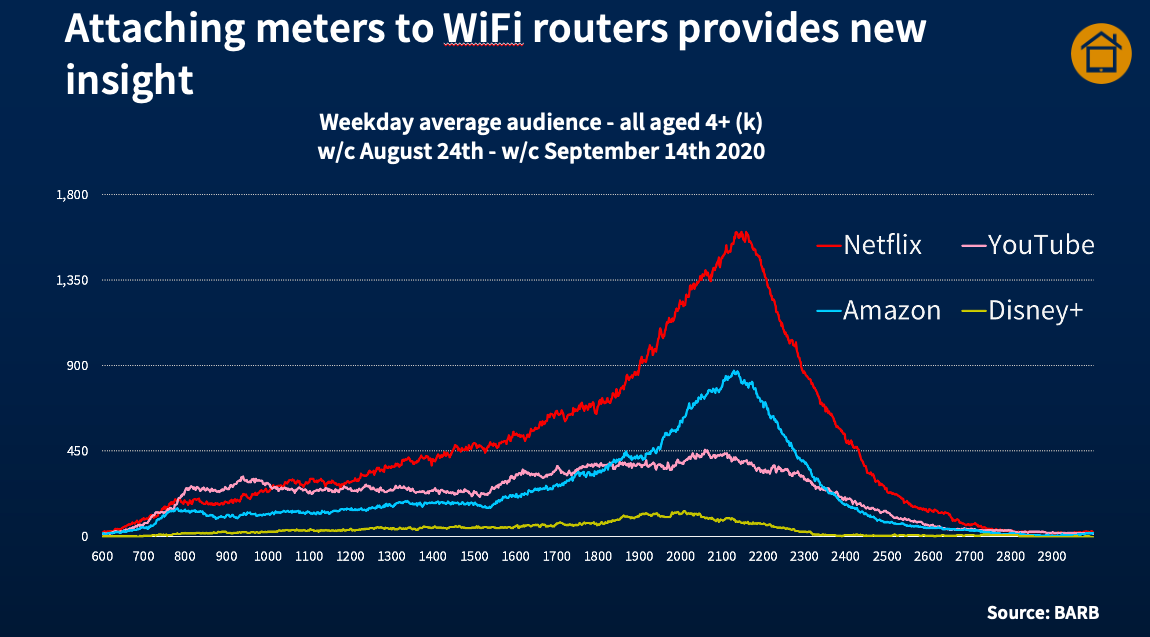

Without their active participation, we rely on data generated by a meter attached to WiFi routers in our panel homes. Kantar has been installing these router meters in our panel and we’re starting to see preliminary data.

The accompanying chart (below) shows TV-set viewing to four of the largest services on weekdays during a four-week period towards the end of the summer.

Notably, Netflix generates significant viewing levels during the evening, hitting a peak of 1.6m during the prime-time slot of 9-10pm.

Comparing Netflix’s performance at this time of day with channels such as BBC One, ITV and Channel 4 shows the SVOD service is responding well to the challenge laid down by its CEO. Reed Hastings said in late 2019 that the real competition is for share of consumers’ evening viewing.

We expect to have more news early next year on how we can augment our service-level viewing data with SVOD content ratings.

Turning to YouTube, we see a consistent TV-set audience of over 300k viewers from 4-11pm. On top of this, we also collect viewing on tablets, PCs and smartphones; these screens are disproportionately important for the leading video-sharing platform. And we know that children tend towards watching YouTube on TV sets and tablets, while smartphones are the go-to device for 16-34 year olds.

And Pareto’s law applies to YouTube: 80% of viewing is accounted for by 20% of viewers. Digging deeper, 47% of YouTube viewing is accounted for by just 5% of viewers. As you might expect, our data confirm the heaviest viewers are more likely to be children, young adults, male and upmarket.

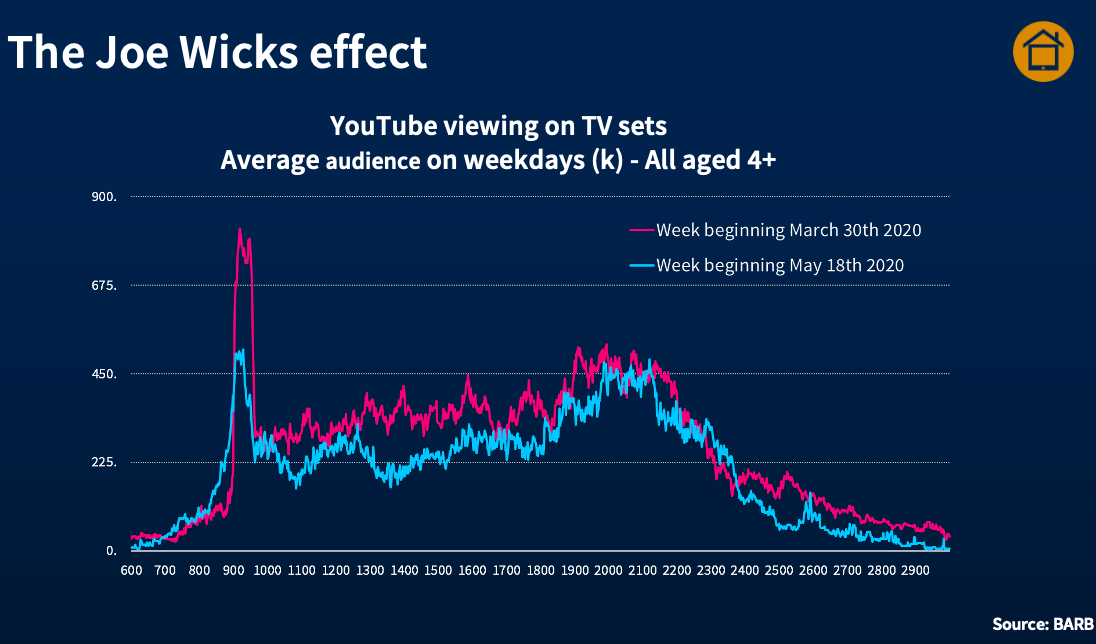

Identifying the content viewed on YouTube is a different challenge, yet it’s already clear some events drive viewing to YouTube.

Early in lockdown there was public acclaim for PE with Joe, a keep-fit show targeted at children. Posted on YouTube at 9 o’clock each morning, we see the spike it created in YouTube viewing on TV sets.

This is particularly pronounced in the second week of lockdown, although there is a decline by week nine of lockdown. It’s a bit like that new year resolution to go to the gym regularly – the enthusiasm just seems to wear off.

All our preliminary data highlight the importance of children to the YouTube proposition. Put alongside the increased regulatory scrutiny of how children are exposed to editorial and commercial content, this raises the question of why an industry measurement solution such as Origin is ignoring this audience.

So what does our progress in measuring the viewing of online services mean for our conversations with Origin?

We are on course to include SVOD and video-sharing platforms as part of our daily reporting by the middle of 2021. So one question is how does our audience measurement intersect with Origin’s. This partly relates to scope, but also to how our respective data sources could be integrated.

Any data integration comes with risks which are magnified as more data sources are incorporated. Multiple panels with varying levels of sampling error increase the possibility for confounding factors that reduce the value of the outputs.

Equally any data integration opens itself to being undermined if there is inconsistency in the inputs. This is why BARB’s experience – and advice – is very clear: audience building blocks need to be consistent across different types of video. This aligns very specifically with one of the WFA’s core principles.

But what does this mean in practice. How can we ensure currencies are built on consistent inputs?

Our industry is committed to the standards BARB has reported for many years. These rely on duration-based measures of viewing and the idea that content is completely viewable.

And it’s not just BARB that thinks this way. Looking at industry standards around the world – including those set in the US by the Media Ratings Council – we conclude the reporting of total and average viewing duration isn’t a nice-to-have: it’s a must-have.

The Media Ratings Council also takes the view that video impressions should have 100% of pixels on screen, which meets Keith Weed’s concern about half-full tubs of ice cream. This standard also sets an expectation that viewable impressions should be filtered for invalid traffic.

In this context, BARB and our stakeholders across the industry would question any industry measurement system that sets out with the view that all impressions are in scope. Is this a real requirement for advertisers?

A failure to insist on consistent inputs undermines a principle that’s important to both the WFA and BARB. This is why we are changing our position regarding access for onward-distribution licensees who want to use our data as part of delivering a data integration.

If this is for the purposes of reporting cross-media campaign performance, these licensees will need to demonstrate how the other data sources use industry-agreed definitions which are, where appropriate, objectively equivalent to BARB data.

While we hope Origin may meet this requirement, we expect other potential licensees won’t.

Justin Sampson is CEO at BARB