AA/Warc upgrades UK ad market forecast to record 18% growth

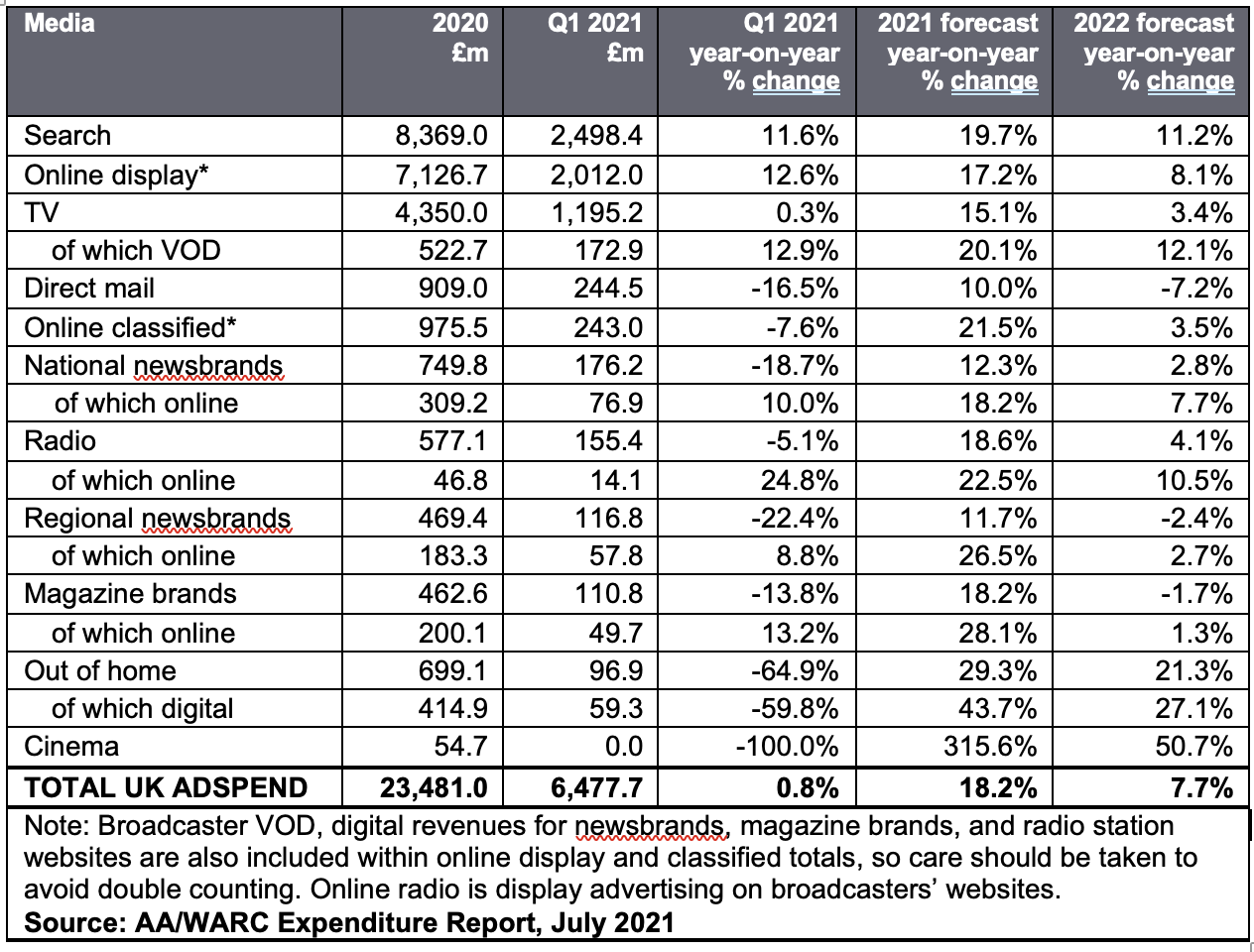

The latest Advertising Association/WARC Expenditure Report predicts that UK adspend will grow by 18.2% this year to reach a total of £27.7bn.

This is an upward revision from the 15.2% rise forecast in April and includes an estimated 54.7% rise during the second quarter of the year – by far the highest on record – after the Covid-19 pandemic caused the market to plummet last year.

This growth will recover the entirety of 2020’s £1.8bn decline and is expected to precede a 7.7% rise in 2022, by when the market will be worth a record £30bn, the report says.

The projected figure of 18.2% growth this year would be the largest rise on record, surpassing the previous high of 15.9% growth set in 1988.

Other forecasts from WARC also suggest the UK is on course to achieve the fastest ad trade recovery of any major European market this year, and one of the strongest growth rates across 100 global markets.

Advertisers becoming ‘very reactive’

TV adspend is expected to increase by 15.1% in 2021 (a significant upward projection from the 8.8% forecast in April), reflective of increased activity during the Euros.

Tim Greene, Head of AV at Spark Foundry, told Mediatel News he did not think anyone could have predicted the levels of spend that have returned to the UK market this year.

“The AV market has been extremely volatile, with many advertisers becoming very reactive, as the UK’s path out of lockdown has unfolded,” Greene said.

“This, along with the AB flexibility extended by sales houses has encouraged advertisers to hedge their bets for longer, leading to more cash at later points than I can remember seeing in TV.

“Not only has it taken agencies by surprise, but it has also taken clients by surprise with late increases of inflation within the TV market place.”

Media most adversely hit by the pandemic are set to bounce back strongest, such as cinema at +315.6%, out-of-home at +29.3%, of which digital OOH at +43.7%. Online classified investment is set to rise by a fifth (21.5%).

Online display, which includes social media and online video – is set to see faster growth this year (+17.2%), as is the case for search (+19.7%).

Nicole Lonsdale, chief client officer at Kinetic UK, cited the WPP OOH agency’s Alfresco Life research that showed OOH weekly reach is at 96%, which is back to pre-pandmeic levels.

She added: “[OOH is] reaching around 31 million adults each day. In addition, the commute is back for many of the working population, with reach on transport expected to be at pre-Covid levels by September.”

The picture in Q1 2021

The latest dataset includes actual adspend figures for Q1 2021, which show UK advertising spend rose 0.8% to £6.5bn during the first three months of the year. This is behind the 1.8% rise estimated in April.

Greene said that the Government’s roadmap announcement had an immediate impact in March, when TV revenues grew by 10%.

“That momentum continued into April, May and June with Q2 revenues now expected to be up 79% year on year but more significantly up +6% on 2019,” he said.

“However volatile it has been, it is very encouraging to see that the AV marketplace is back in full swing. Looking forward, I would expect a late cash market place to remain for the near future.

“Despite this, we are very hopeful that the call-and-response game between Government and advertisers is ending, and the unprecedented late-cash releases will become more controlled.”

During the first quarter, online formats – most notably search, online display and Broadcaster VOD – grew by double-digits during the quarter. Out-of-home spend was down by almost two thirds and cinemas remained closed as the UK adhered to lockdown and social distancing restrictions.

Sectors that also saw year-on-year decline in Q1 were direct mail (-16.5%), national newsbrands (-18.7%) and regional newsbrands (-22.4%).

Stephen Woodford, CEO of the Advertising Association, said:“These are hugely encouraging figures for the UK advertising industry and reflect the strong outlook in the wider economy.”

He added: “The UK is the global hub for advertising and will also benefit from faster growth in major export markets for UK advertising services. If the AA/WARC expenditure estimates turn out as forecast, then the ad industry will contribute strongly to the nation’s economic resurgence this year and into next.”