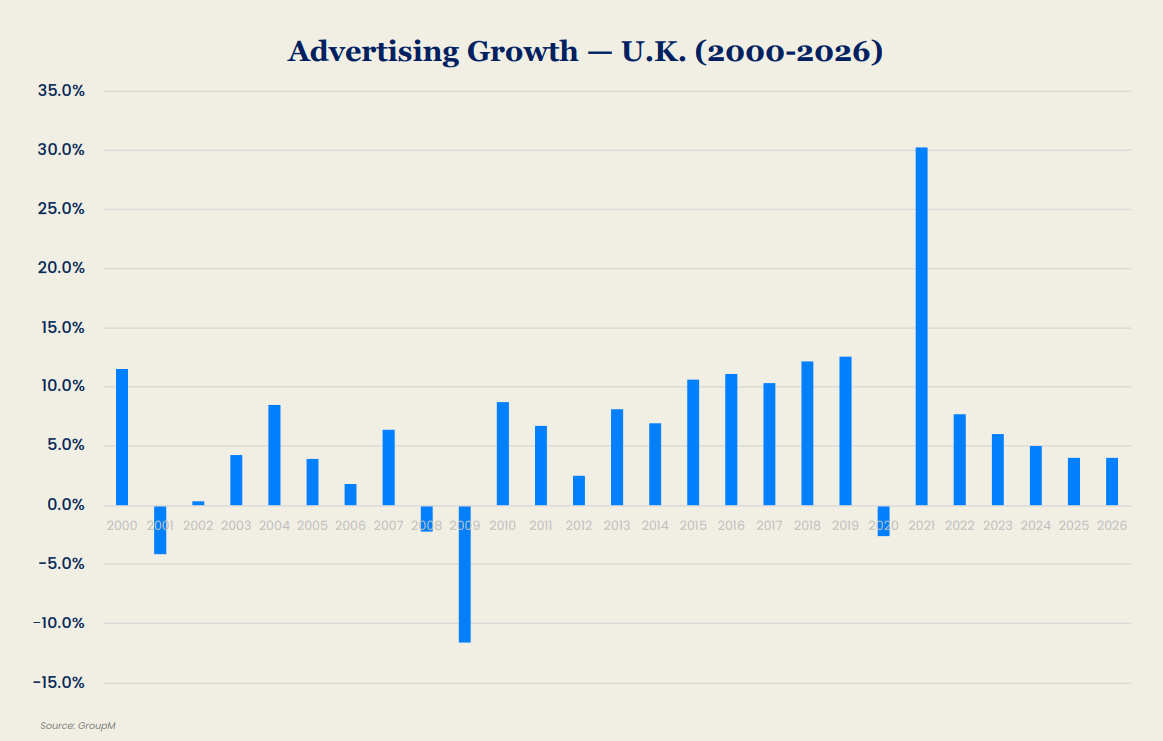

UK adspend to grow by 30% in upgraded GroupM forecast for 2021

UK advertising is predicted to grow more than previously anticipated this year, according to GroupM’s ThisYearNextYear report.

The WPP media agency group upwardly revised its forecast of overall UK ad industry growth to 30% for 2021, 6% higher than its previous June forecast, driven by even stronger-than-expected growth in television and digital and economic factors suggesting a strong recovery from the pandemic.

The report highlighted 2021 should be the third-strongest economic growth rate since 1955 for the UK if economic growth is examined on a year-over-year basis – when UK adspend shrank 2.6% by at the height of the Covid-19 pandemic.

It also noted that while there are still “speed bumps” like Brexit-related staff shortages and supply chain issues, combined with rising infection rates to consider, these should be ‘manageable’.

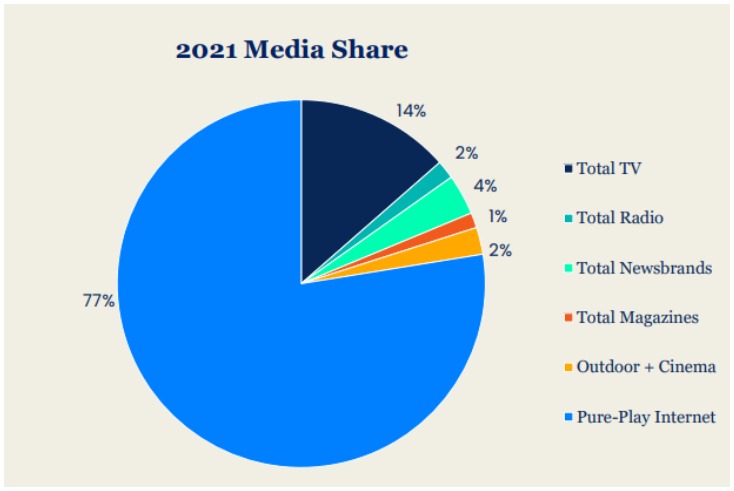

Most of this growth can be attributed to digital advertising driving ad market revenue with GroupM now expecting 34% expansion in digital this year compared to its previous estimate of 27%.

Growth by media channel

TV is expected to experience 19% growth in advertising revenue in 2021, higher than 13% previously predicted in June, partially down to summer growth in line with England’s success in the Euros which continued into Q3.

The report also pointed out that shortening of advance booking deadlines may have contributed to more advertisers investing in TV, particularly digital brands conducting short-notice tests.

Another element pulled out in the report was “surprising” TV revenue growth in September grew 28% year on year, driven by nearly all categories increasing spend compared with September 2019.

Popular sports content and growth in VOD and Connected TV+ advertising were also emphasised as key factors in driving TV ad revenues, although GroupM anticipate there may still need to be some caution around November and December given what was seen in those months in 2020.

Digital advertising is set to grow by 34% this year, in contrast to GroupM’s previous figure of 27%.

This expansion is mostly down to scaled digital platforms reporting high revenue gains in the previous quarter.

A “sustained rise” in competitive companies with more advertising investment power was named as a contributing factor to this digital revenue increase, with an example of grocery delivery start-ups like Weezy, Gorillas and Getir advertising in central London.

The report also said: “We do not expect ad-targeting headwinds to have any meaningful impact on media investment pounds flowing into digital. This is because the industry’s scaled digital media owners will continue to have relatively more data than others which allows them to capture the bulk of data-driven ad spend.”

Audio has recovered faster than expected, with 18% revenue growth expected compared with 2020, which is based on no more national lockdowns for the rest of 2021.

The report anticipated continued growth in audio ad spend into 2022 as companies look into smart speaker and podcast experiment and investment opportunities, which Global commercial director for audio Katie Bowden also highlighted in a recent interview with Mediatel News.

Print looks set to decrease revenue in the short-term due to consolidation by companies like Future PLC.

It should return to single-digit growth in 5 years, however, the report stressed that digital print revenue growth should outpace non-digital by 2023.

OOH continues to rebound as people go back to work and restrictions are eased, although this has been less dramatic than predicted.

GroupM forecasted that a return to pre-Covid levels of OOH advertising revenue may not materialise until 2022.