Has Christmas come early this year?

Consumers’ search and behavioural patterns can tell us a lot about what media planners and marketers need to watch out for amid the continuing pandemic and Brexit

The emergence of the mega sale is quite apparent – seasonal promotions are starting earlier and lasting longer – Christmas is a combination of sales periods, running into each other, with less distinction from one to the next.

Add the challenges of Brexit and lorry driver shortages may mean that consumers start looking to purchase earlier than they did last year.

Currys and John Lewis followed that approach in 2020 – Currys launching a two-day “Epic Sale – Get your Christmas Gifts early” on 13 October. This then merged into a 30% clearance sale on 15 October, which in turned merged into a pre-Black Friday event starting on 15 November (“we’ll refund the difference”), with Black Friday itself starting on 22 November.

JLP ran a generic 20% seasonal sale from around 15 October until early November, with Black Friday similarly starting on 22 November – ahead of the day itself on 26, with Cyber Monday on 30 October.

In both cases sales stopped following Cyber Monday.

Will this trend be repeated in 2021?

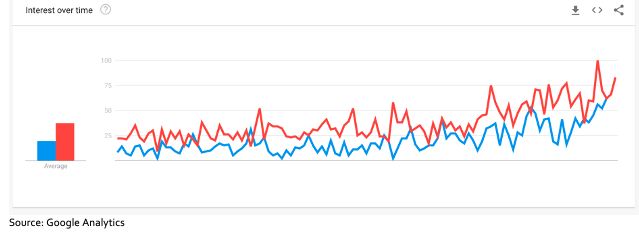

Thus far, consumer interest is below that of 2020.

Search interest in the term “Black Friday 2020” exceeds that of 2021 – looking at the period 1 June to 21 September:

While that same trend exists for “Christmas gifts”, with interest in 2021 tracking below that for the same period in 2020 (1st June – 21 September). It is more marginal and, tracking the same curve, interest is gaining momentum at a similar point in time.

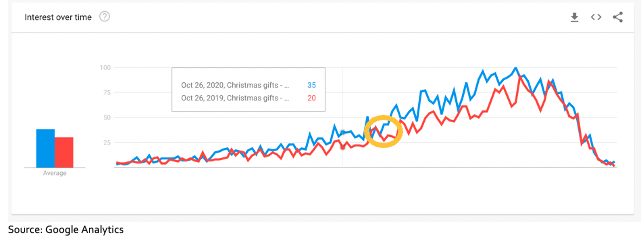

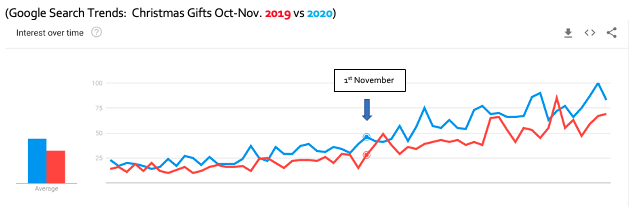

When looking back to last year, it is worth remembering that 2020 was a very different landscape – the UK had been ‘unlocked’ but rising Covid-19 numbers through the Autumn meant that a second lockdown was announced on 31 October. The timing of this had an evident impact on search and behavioural patterns.

Search interest in “Christmas gifts” in 2020 was marginally tracking ahead of 2019 up to the Government announcement; however, from 5 November, the day lockdown started, we see interest accelerate YoY.

In both years, interest peaks the first weekend of December on the Sunday/Monday. (Anecdotally, using TV pricing as the barometer, it is a long held tradition that post-5 December, TV pricing drops like a stone as retailers’ campaigns come to an end).

Amazon offers a not dissimilar picture. November is by far the standout month, with Amazon peaking a week earlier than the general market trend. An added point of note is that Prime Day 2020 fell in October. yet appears to have failed in bringing Christmas ‘forward’.

Based on the current climate, 2021 will look and feel different to 2020 at least from a Covid-19 point of view.

With the nation in some form of restriction throughout the Autumn and impending lockdown in 2020, it could be argued that the nation was simply bored and Christmas became the point of focus.

So how important is October?

Search interest in gifting clearly picks up from October – but search (or rather, research) doesn’t necessarily reflect sales. There becomes a real challenge of balancing presence in the research phase knowing that ROI will be impacted, as consumers await the sales they know are coming.

We saw this in July, with Prime Day – pay-per-click (PPC) and performance media both did well in terms of cost-per-click (CPC), yet we saw ROI significantly drop. Shoppers in-market researching, comparing price – and ultimately converting where it was most competitive.

This is a key consideration for Q4. Customers know the situation: is a 20% discount in October attractive (enough) when they know that Black Friday could mean 30% off?

Looking at Black Friday itself, we can see just how much bigger an opportunity November is versus October:

Data from Amazon (specific to smartwatches for the purpose of this example, above), highlights the search levels prior to Black Friday, the increase in search as consumers start their Black Friday research, two weeks out, and then the huge surge on the day itself.

Outside of Black Friday, search is remarkably consistent. Note also the focus on one day – Black Friday promotions last four days, yet they drop off on Saturday.

This is possible further evidence that it is the do-or-die purchase moment: consumers are well versed in the seasonal sales cycle. The best price on Black Friday is the best price they’ll see.

What does this mean for media and marketing?

It’s important to maintain presence in October in PPC. ROI may decline, but absence at this critical point means that you reduce presence in a key research phase – we know we will be building retargeting pools, to be exploited once key sales launch.

We should also be testing sales. We know sales start in October, but how effective these might be is questionable. One option would be to test secondary product line/sale message and assess whether traction can be made.

Advertisers must also give sales messaging context. Consumers are presented a chaotic scene when it comes to seasonal sales, but how long will they last? How good is the discount? The more context you can provide the more confidence your consumers will be in a deal.

And, because it’s Christmas (soon), here are three more conclusions:

- Use ‘countdown’ extensions – counting down the days to sale end drives performance

- Upweight budget in Display and PPC in November

- Integrate social into PPC plans to ensure brand message is also delivered.

Nick Smith is chief digital officer at John Ayling & Associates