Yes, Share of Search is a key marketing metric – just ask ASOS

Far from being a “dirty metric” that big brands have little to gain from, there is clear evidence SoS should be a leading measurement standard for advertisers.

It’s right that all new metrics are held up to rigorous inspection but, contrary to the conclusion of Niki Grant last month, the reason why marketers instinctively know Share of Search (SoS) should be a leading metric comes down to both science and common sense.

On the science side, the Share of Search think tank has shown at the IPA EffWorks Conference this month that SoS accounts for around 83% of a brand’s overall share of market figure. It may not be an exact match but there is a compelling correlation.

It was fortuitous the research was published last week because it coincided with ASOS releasing a profits warning accompanied by the immediate resignation of its CEO and a vow to up its marketing spending significantly.

The fashion brand was one picked out by Grant as having little to gain from studying Share of Search. To the contrary, though, if one looks back over the past four years there is a clear indication that ASOS needed to pay attention to the metric, which just may have been an early warning sign.

But before diving into the data in detail, it’s worth starting off with a macro view of what we intuitively know about search.

Search is how we discover and buy

The first time any of us hears of anything, we search it up. When you want to find out more about a company, you search for them, when you want to buy a product or service, you search for it. It might be on Google, Amazon, Google Play, YouTube or Bing, or another search engine, search is at the centre of how we discover and find out more about a brand and its products or services and buy them.

With the right tools in place, that gives companies lots of clean data on the total number of searches for each brand in its category and from that, each company can determine its share.

There is a risk SoS can be artificially inflated by a crisis – Grant was correct about that – and so it is mandatory to combine search data with social listening. It’s important to understand positive and negative search patterns so a brand does not mistake people showing disdain for the business as a good marketing outcome.

A crucial point is: you cannot look at the data for one day or one week and walk away with a conclusion. This is all about picking out trends which can be clearly seen when the right search terms are used consistently over time. It is also important to make sure these terms are correct, for the right category.

So, with M&S, one would make sure that when looking at clothing the right filters are in place to avoid search terms for food and homeware featuring.

The rise and fall in fashion

When this is done, and results are compared with competitors, you can start to see some compelling narratives. In fashion, it becomes clear that both ASOS and M&S have a lot to gain from paying attention to SoS.

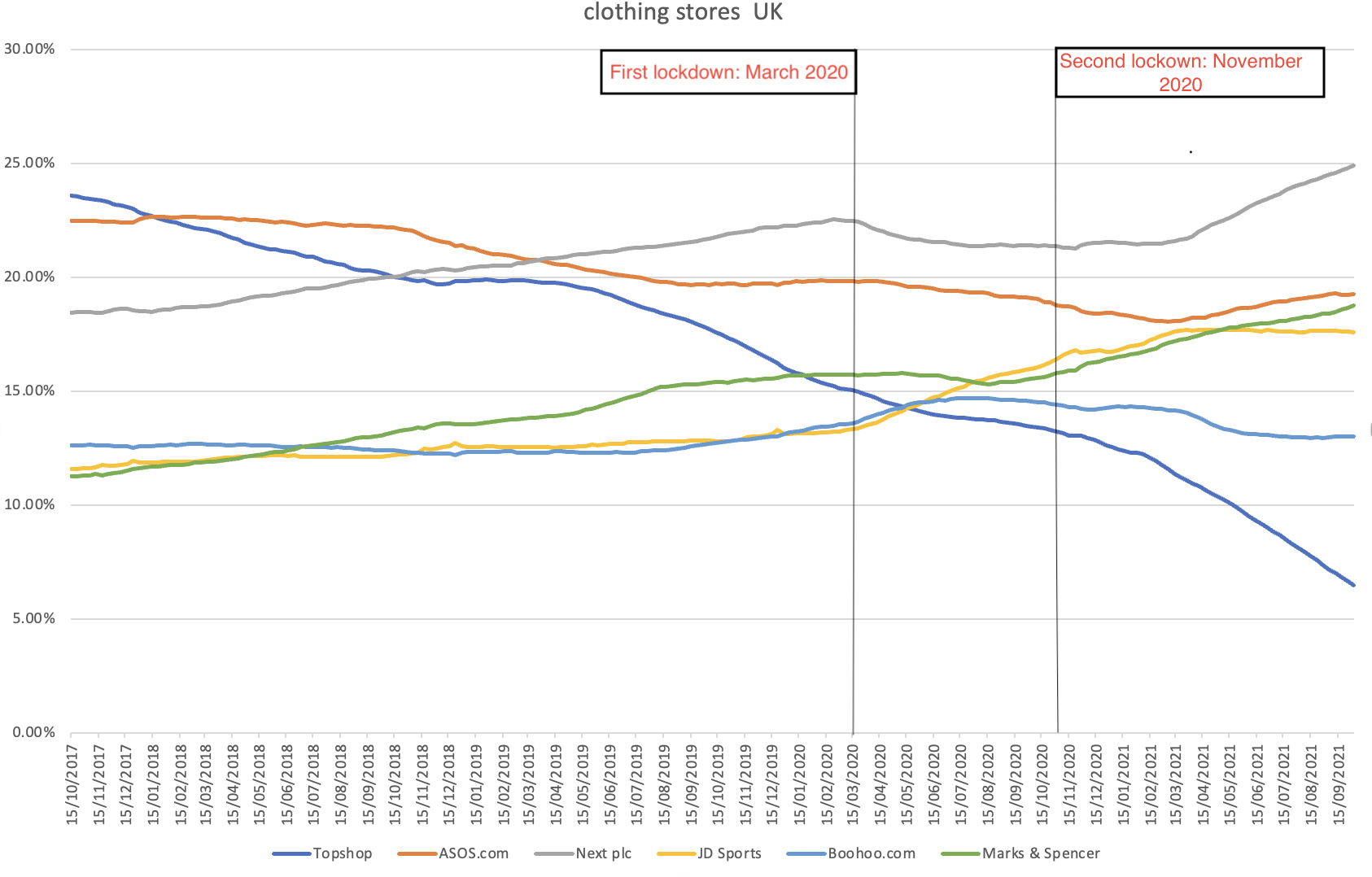

Over the time period in the graph, there are two obvious declines. Top Shop was riding high at the top of the search charts in 2017 but then as it failed to adapt to online shopping behaviour and we can see it slips in popularity, overtaken by ASOS. The final nail in Top Shop’s coffin was shutting its flagship stores and Covid. It did not offer a compelling ecommerce service so people did not search for it online, and when it gave up on the high street, the writing was on the wall and it was bought by ASOS.

Take a look again at the graph and there’s an unexpected downward trend at ASOS. It’s the online success story of UK fashion but its Share of Search declines over the period. It initially appeared to pick up as Top Shop’s popularity waned. However, more traditional high street retailers, such as Next and, particularly, Marks and Spencer, then see a lift in interest when lockdown forces shoppers online.

Curiously, ASOS maintains a steady decline. BooHoo showed signs of picking up during the country’s first national lockdown but then, in July 2020, headlines of poor worker conditions in its supplier factories saw that growth taper off back to previous levels.

The overall story is Top Shop crashing out of the market, while ASOS sees a steady decline at the very moment you would imagine an online retailer would be soaring in share of search. Instead, it is the stalwarts of the high street, Next and Marks and Spencer, that make big gains over the period.

There could be many reasons for this. Perhaps people who would normally shop on the high street started searching for familiar brands and maybe those familiar names had the right casual clothing proposition for a period of working from home and not going out – JD Sports’ increasing popularity in search would suggest the past year and a half has been a good time to be selling casual clothing.

An early alarm for ASOS?

What is clear, though, is the data shows ASOS was experiencing an SoS problem at least a year or more before it announced a potential 40% reduction in its anticipated profits and the departure of its CEO. It blamed supply issues and any business person will know what a challenging time it is for any brand operating with an international supply chain.

At the same time, however, a curious marketer might be tempted to ask if there is something more integral to the brand also at play here. A declining SoS at exactly the same time shoppers are forced to move online not only foreshadowed its current woes but also suggests the brand is right in thinking it needs to spend more on marketing to boost market share.

Far from being a “dirty metric” that big brands have little to gain from, then, there is clear evidence SoS should be a leading metric. It reveals brand health through the level of interest the public devotes to a company.

That can give cause for celebration or serve as an early warning sign. Either way, brands would do well to take note.

Frederique Pirenne is co-founder and chief science officer at share of search company My Telescope