Bellwether Report: surge in ‘big ticket’ campaign spend

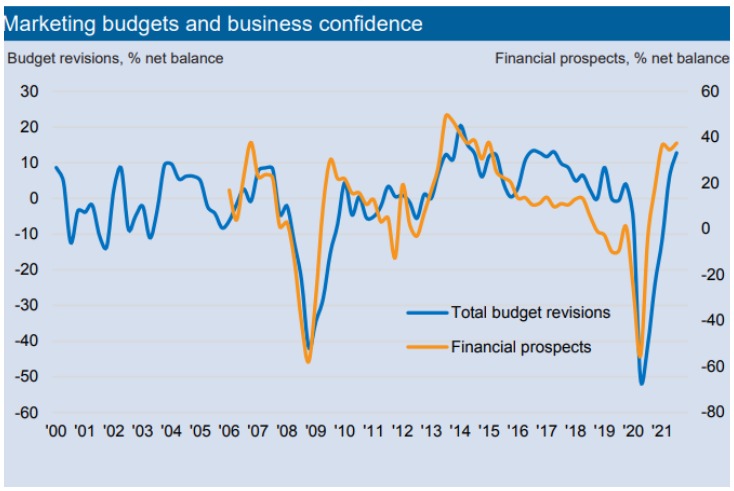

The IPA released its quarterly Bellwether Report today indicating strong recovery from the pandemic with marketing budgets and adspend increasing.

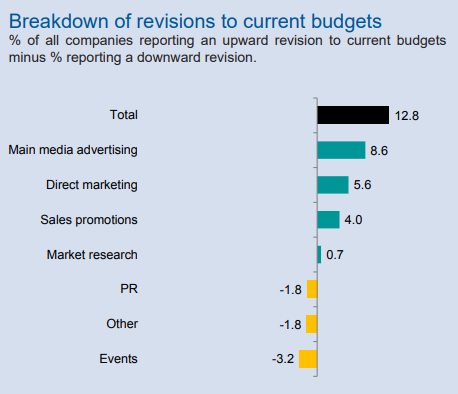

The Q3 2021 survey found that total marketing spend grew at a net balance of +12.8%.

As a result, company-level financial forecasts and business confidence were optimistic going forward.

The report’s key findings are:

- UK marketing budget growth is at its strongest since 2017

- High consumer demand, vaccination roll-out and easing of restrictions were cited as key factors

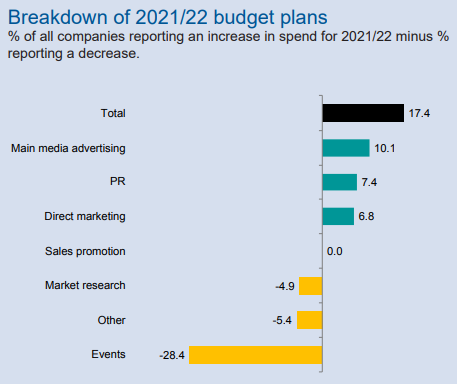

- Adspend is on course to significantly increase between now and 2022

However, IPA director-general Paul Bainsfair warned that there were widespread concerns among Bellwether panellists about “supply shortages and issues with transport could hinder their business operations.

“[The shortages could] also impact their sales performances as many firms pass on these higher costs to their own selling prices,” Bainsfair added.

Bainsfair noted it is “particularly good” to see that companies are investing more in main media ‘big ticket’ campaigns. These larger campaign budgets were revised up to the greatest extent since Q2 2017.

Within main media advertising, which increased the most out of any marketing budget segment in the third quarter with a net balance of +8.6%, video was the main driving force with +12.6%, then online with +10.6%, audio with +6% and published brands with +5.2%, while Out of Home (OOH) fell by -2.0%.

John Wittesaele, EMEA CEO at Xaxis said of the stand-out video budget increase: “Brands now have greater control than ever to ensure contextual relevance, format suitability, and adaption of the message to the device or environment it is viewed.”

He added: “If video capabilities continue to expand, and integration across formats, channels and platforms keeps pace with consumer habits, we can expect it to be a star performer in Q4 2021 and throughout 2022.”

James Copley, CEO of Talon Outdoor took issue with the OOH figures: “It’s interesting to see that the Q3 IPA Bellwether report shows marketing spend in Out of Home (OOH) fell by -2.0% despite budgets increasing at the strongest rate since 2017, especially as recent Outsmart data shows UK OOH ad revenues are experiencing record growth, with the period from April to June growing 277% YOY.”

He said OOH is seeing “very strong pre-covid level client demand” throughout Q3 and into Q4, which he expects to continue into next year.

Lee Lythe, chief investment officer at Spark Foundry also highlighted the potential of OOH advertising as she said: “It appears that Out of Home is the one advertising medium that some marketeers are currently overlooking, with the majority reducing or keeping budget levels the same.

“As the UK streets and transport networks come out of hibernation, there is value available and brands should be looking to capitalise.”

Joe Hayes, senior economist at IHS Markit, who research and publish the report on behalf of the IPA, added: “We couldn’t have imagined such a fast recovery in economic activity earlier in the year when lockdown measures were at their most stringent.

“We’re expecting UK GDP to have recouped all pandemic-related losses by no later than mid-2022, and Bellwether panellists have provided us with even more evidence that firms are working hard to re-grow their businesses, with one-in-four upwardly revising their total marketing budgets.”

The Bellwether Report is researched and published by IHS Markit based on a survey of 300 UK marketers representing key business sectors mostly from the country’s top 1000 companies.