How Disney+ and Netflix rivalry is moving beyond streaming

“We are extremely pleased with the success of our portfolio streaming service,” Disney CEO Bob Chapek declared during the company’s call with investors last week.

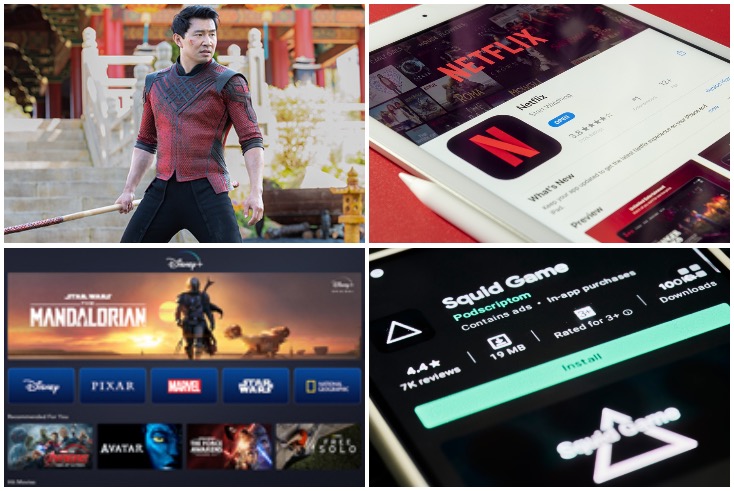

Chapek was speaking two days before the two-year anniversary of Disney+, the media giant’s subscription streaming service, which the company is now marketing as “Disney+ Day”. The milestone was marked with the release of a Marvel movie and a spate of promos for upcoming movies and TV shows.

Then came the release of yesterday’s IPA Touchpoints data yesterday which shows Disney+ has taken viewing time and share from Netflix, the global streaming incumbent. Netflix began offering streaming in addition to DVD rentals from as early as 2007, but it was only in 2013 when it released the big-budget political thriller House of Cards, that subscriber numbers and its share price really began to take off.

But, given what Disney and Netflix’s leaders have said in recent weeks, they are eyeing quite different content and experience strategies to retain and gain subscribers.

Disney+ to double franchise content

Chapek said last week that Disney+ was “on the right track” and would reach between 230 million and 260 million paid subscribers globally by the end of fiscal year 2024, with the product aiming to achieve profitability that same year.

He added that Disney+, ESPN+, and Hulu continued to “perform incredibly well” with 118.1 million, 17.1 million and 43.8 million subscribers respectively.

Chapek highlighted that Disney+ subscriptions have grown by 60% over the last financial year, and across the whole portfolio it has grown by 48%.

Disney+’s strategy for this coming year was focussed on a “surge of new content” with more than 340 local original titles in various stages of development and production across its direct-to-consumer (DTC) platforms.

Chapek said: “In total, we are nearly doubling the amount of original content from our marquee brands, Disney, Marvel, Pixar, Star Wars and National Geographic coming to Disney+ in FY ’22, with the majority of our highly anticipated titles arriving July through September.

“We recognise that the single, most effective way to grow our streaming platforms worldwide is with great content, and we are singularly focused on making new high-quality entertainment including local and regional content that we believe will resonate with audiences.”

Disney+ is now in over 60 countries and more than 20 languages, and plans to more than double the number of countries it has a presence in to over 160 by fiscal year 2023 including in Asia, Central Eastern Europe, the Middle East, and South Africa.

Netflix eyeing new frontiers amid increasing competition

Meanwhile, Netflix told investors during its third-quarter earnings call last month that it has reached the “tail end of the Covid choppiness”. Pandemic-related production delays, which have blighted its Q1 and Q2 content slated, would soon come to an end.

Rather than boast about a “surge” or “spike” in user numbers, Netflix instead used the phrase “uptick in growth” to describes the growth of viewer number in the most recent quarter. Netflix currently has over 200 million subscribers, and is adding between 8 million and 8.8 million net subscribers per year, according to co-CEO Reed Hastings.

While Hastings emphasised “uncharted territory” – with so much content coming in Q4 like “never before” – he acknowledged the competition in the streaming space to be the “first choice in entertainment”.

South Korean hit series Squid Game featured heavily in this earnings call. The company has hailed the horror thriller as its most successful ever launch for an original series. Ted Sarandos, co-CEO and chief content officer, also pointed to La Casa de Papel from Spain, Lupin from France, Blood Red Sky from Germany, Sex Education in the UK, Sintonia in Brazil, Chestnut Man in Denmark as “enormous success” for Netflix.

Hastings highlighted its all-around experience and consumer products as its next direction for strategy: “Maybe imagine three years from now and some future Squid Game is launching, and it comes along with an incredible array of interactive or gaming options and it’s all built into the service.

“And then you’ve got your off-Netflix aspects, the experiences that we’re building out, consumer products, all of that coming together.”

He acknowledged that “a company like Disney is still ahead of us in some of those dimensions of putting that whole experience together” but that Netflix is making progress in closing that gap and hopes to pass them on that “spectacular all-around experience” in the next three to five years.

Netflix has since announced the launch of Netflix Gaming (pictured, above), an added benefit for subscribers in which they can play games on smartphones. Two of the five titles it announced were spin-offs for the hit Stranger Things show, and only available on Apple devices.

Disney+ will take longer to catch Netflix than expected

And yet, despite the recent successes of Disney+, its user growth has actually been underwhelming compared to what researchers previously expected.

Digital TV Research has updated its predictions that Disney + would overtake Netflix in subscriber numbers in 2027 – rather than 2025 as it previously forecast –based on September 2021 results.

Simon Murray, principal analyst at Digital TV Research, added: “Disney+ only started in six new countries during 2021. Delayed from 2021, the Eastern Europe launches will take place in 2022. This is likely to push back the remaining Asian launches to 2023.”

The research added Disney+ will be the biggest gainer in subscribers in that time adding 140 million subscribers between 2021 and 2026 to taking it to 271 million.

The report noted nearly 40% of this total, about 102 million, will be in 13 Asian countries under the Hotstar brand in 2026.

The research found that by 2026, 53% of the world’s 1.7 billion subscription video on demand (SVOD) subscriptions will be controlled by US-based platforms Netflix, Disney+, Amazon Prime Video, HBO Max and Apple TV+.

Meanwhile, Kantar’s SVOD usage data also indicates that, for July to September, Disney+ had a 17.7% share of new subscribers in the UK, the second-largest behind Amazon Prime Video,

In terms of share of all SVOD subscribers in Great Britain, Netflix is still dominant with 74.8% but Disney+ is catching up with 21.8% .

The report highlighted there were 16.7 million VOD-enabled households in Great Britain as of June 2021.