Television’s tortoise race

As BARB finally upgrades its audience reporting to include SVOD data, Dominic Mills looks at the changing dynamics of reach and what’s happened to Project Origin.

It would be mean to describe BARB as a tortoise but the point about tortoises is that, possessed of an indomitable spirit and confident of their direction, they do eventually reach their destination.

And so it is with BARB, which today (29 November) unveils what boss Justin Sampson calls a “once-in-a-lifetime” upgrade in its audience reporting with the incorporation of SVOD and video-sharing platform data.

That, in plain speak, means it can now offer daily stats on the viewing levels to Netflix, Amazon Prime etc, plus the likes of Youtube and TikTok across four devices — TV, mobile, PC and tablet. Mediatel News already has a good description of what’s on offer here.

By the way, and whether it is serendipity or good targeting I can’t say, but above the Mediatel story I spied a banner ad from Samsung Ads for its Behind the Screens report, which, via Samsung’s large smart-TV user base, offers a complementary view on the shifts in the TV landscape between linear and streaming consumption albeit on a multi-market basis.

BARB’s news is indeed a big step forward, and one that is bound to give agencies and advertisers more confidence in the way they allocate their budgets. Whether that means they shift over time, and in which direction, we shall see.

My guess is that most of the debate will revolve around reach. Linear TV has historically positioned itself as offering the broadest, fastest reach, generally claiming that everything else offers incremental reach — i.e mopping up the long tail.

Despite YouTube’s best efforts to fight this, particularly with 16-34 year old audiences, this consensus has not shifted much.

It may change now. By the time you read this current figures will be available, but I’m going by the figures in BARB’s White Paper, which cover October 2020 to September 2021.

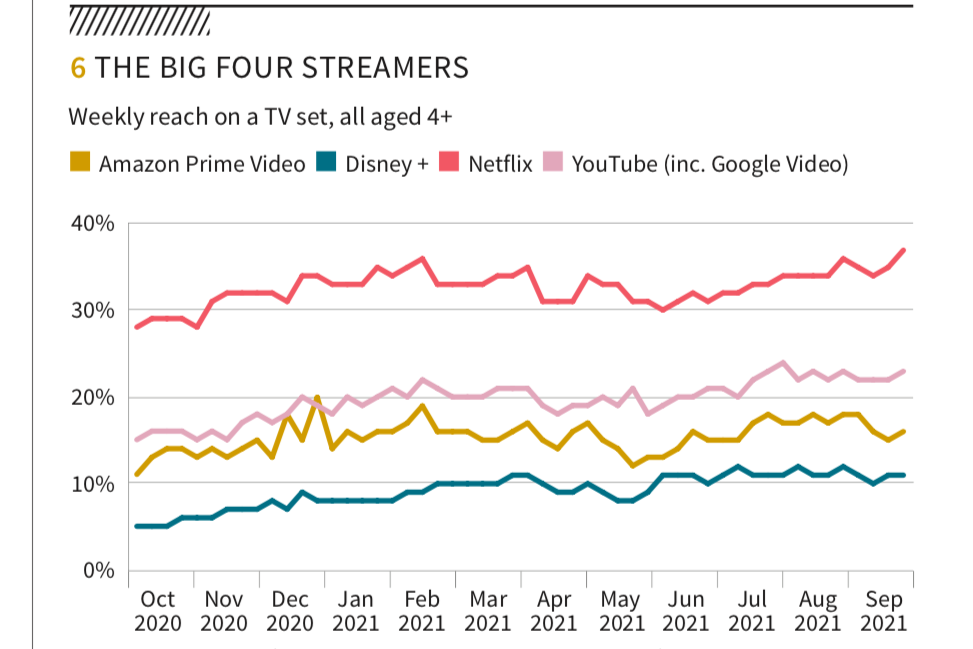

From these we see a pronounced increase in non-broadcaster reach: Netflix from 20% to 35+%; YouTube from 16% to 22-3%; Amazon Prime from 11% to 15+%; and Disney+ from 5% to 11-12%. And that’s not including TikTok, for which I don’t have the figures.

I should add that the figures also don’t include Facebook, apparently on the grounds that BARB panellists don’t regard it, unlike Youtube, as a video-sharing platform.

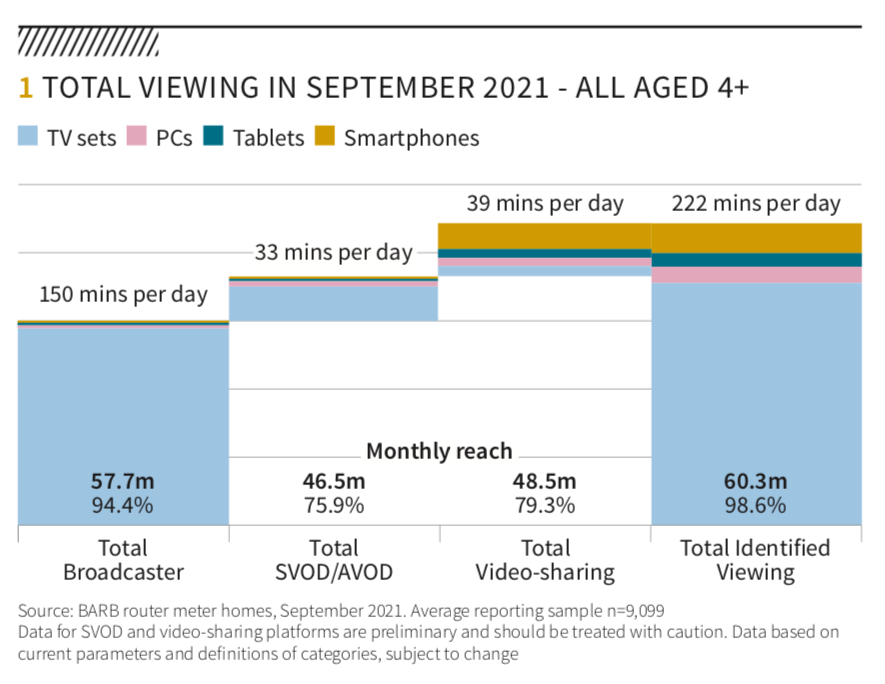

Looked at cumulatively, total broadcaster reach on a monthly basis remains high — at 94% — but the SVOD/AVOD cohort has a decent story to tell, with reach at 75.9%, as do the video-sharers at 79.3%.

There are probably two reasons for this. One, the SVOD/AVOD users tend to be high consumers of all TV anyway, so this is far from a zero-sum game; and two, as I have been told, Youtube viewing is heavily concentrated — with 50% of YouTube viewing coming from just 5% of viewers.

It will be interesting to see how YouTube, which has consistently declined to play ball with BARB, takes this. One area I expect it will cause a fuss about — perhaps rightly — is that the figures don’t include out-of-home viewing.

This is what you might call a known unknown.

We know out-of-home viewing is a thing — we’ve all seen commuters laughing at some video on their mobile or teenagers messing with TikTok on the school bus— but we don’t know definitively how large a piece of the jigsaw this comprises.

In its defence, BARB says it doesn’t capture any out-of-home viewing. But even if it doesn’t much affect YouTube reach, it certainly would boost its viewing time.

And what then of the other measurement game in town, ISBA’s Project Origin?

Beyond the recruitment of ex-YouTube COO Tracey Kitt in September (to replace another ex-YouTuber, Richard Halton), things have gone a little quiet there.

That, I understand, is down to sorting out the next phase of funding. Discussions are in the final stages, but all being well will kick off in January.

[advert position=”left”]

Relations between BARB and ISBA have not always run smoothly over Origin — witness Justin Sampson’s piece clarifying that Origin did not (yet) have BARB’s imprimatur. The language may have been diplomatic, but the message was clear.

Of course, it is true that BARB and Origin set out to do different things, BARB sticking to audience data, and Origin campaign measurement — and should therefore be complementary — but the money complicates the picture.

As long as the broadcasters don’t commit money to Origin, the more it becomes dependent on other sources of funding, in this case agencies, advertisers, Google and Facebook.

ISBA has undoubtedly been successful in getting all three to cough-up so far, but the generosity of the former two is limited.

If, therefore, Origin becomes reliant on funding from the platforms…then what?

Here’s Teads’ Phil Sumner making the point: “Reaching an industry-wide consensus on cross media measurement remains one of the industry’s greatest unsolved challenges internationally, as does the funding needed to support such initiatives long -term.

“As most of the open web relies on ad funded businesses models, fair and equal representation – especially vs. other digital walled gardens – will be critical as to not disadvantage large portions of our vibrant media ecosystem in the UK.”

Diplomatic, but clear.

If you also think of the collective industry as a tortoise — an apt analogy given the need to corral so many views — it’s clear that, that particular destination is some way off.

The ANTHONY mystery

Despite, or perhaps because, I’m a hopeless networker, I’ve been reading a fascinating book called Catalyst, co-authored by an old contact of mine, David Kean.

The thing about networkers is that sometimes they’re blatant and solipsistic, in which case you hate being ‘networked’ by them, and sometimes they’re subtle, fun and rewarding, in which case you like it.

Mr K definitely falls into the latter category, which probably explains why he was so good in his roles as new-business director at BMP DDB (as then was) and later the Omnicom group as a whole in the UK.

In the book he identifies a category of networker who he christens ‘A.N.T.H.O.N.Y’.

It’s an acronym that goes like this:

A = All about me

N = Not interested in you

T = That reminds me of something I did that is a lot more interesting than what you did

H = Happy to talk over you

O = Over your shoulder is someone more interesting

N = Never follows up or says thanks if you help them

Y = You are now, apparently, one of their best friends.

ANTHONYs, Kean says, are often successful networkers, usually with other ANTHONYs I suspect, despite their transparently transactional approach. In my experience they are mostly male, but not exclusively so.

ANTHONY is obviously a generic but also, given the way he meets his come-uppance in the book, a real person.

The question is who. We ‘networked’ over the book, but despite me throwing out a lot of names, he refused to tell me.

Have a go yourself. It’s five stars on Amazon and a snip at £11.50.