AA/WARC Q1 2022: UK adspend outpaces expectations

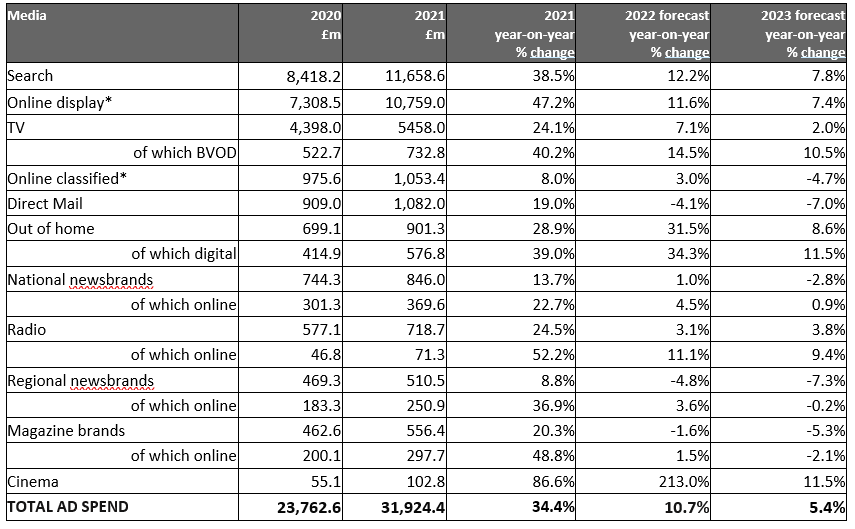

UK adspend in 2021 reached £32bn, ahead of expectations, according to the latest quarterly Advertising Association/Warc Expenditure Report.

This is an increase of 34.3% and an absolute increase of £8.2bn year-on-year, £2.3bn ahead of previous expectations.

Other key findings:

Internet spend increased by 40.5%, or £6.8bn, to a total of £23.5bn. This drove most adspend growth.

While newsbrands, magazine brands, out-of-home (OOH), cinema and direct mail grew last year, they all finished 2021 below pre-pandemic levels.

Entertainment and leisure brands together were the biggest spenders in 2021.

The UK ad market is forecast to grow by an additional 10.7% in 2022. This is an upward revision of 2.2 percentage points since the AA/WARC January forecast.

A 5.4% increase in UK adspend is predicted for 2023, which would put the total value of the market at £37bn.

However Stephen Woodford, chief executive, Advertising Association, warned the industry should be cautious due to “inflationary pressures on the cost of advertising, and more generally, due to the ongoing geo-political uncertainties.”

On the effect of the pandemic on advertising, Woodford added that while lockdowns saw “sharp declines” in spend across some sectors, there were also opportunities to innovate and meet public health challenges.

He pointed out the UK government remained in “pole position” as the largest advertiser with cover wraps in print media with “Stay Home” messaging, direct mail delivering testing kits and essential deliveries and billboards showcasing “everyday heroes” in the NHS (pictured, above).

On rebounding from the pandemic, James McDonald, director of data, intelligence & forecasting, WARC said the Covid-19 recovery last year was buoyed in part by the release of pent-up investment on established online platforms as well as newer ones such as TikTok.

McDonald also cited the emergence of retail media as a “major contender” for marketing budgets.”

“The latter trend bears the hallmark of a new era in advertising, one which is set to fuel growth over the forecast period and beyond,” he added.

Tough times ahead

Pippa Glucklich, CEO of media agency Electric Glue, echoed this “cautious optimism”, acknowledging uncertainty and consumer pressures going forward.

Glucklich said: “Before we get too carried away with ourselves we should remember we’ve been living through extraordinary times – and that the significant economic uncertainties affecting all of us, not least related to war in Ukraine, are set to continue for the foreseeable future.”

She added: “Tough times make people think more. And of course when consumers think more, they often reassess their behaviour and their choices. Those companies who’ve confused customer habit with customer loyalty – like Netflix – quickly discover that they’re not the same. So anyone following the fortunes of the UK advertising market in 2023 and beyond should be aware of the dangers of drawing glib conclusions from trends and behaviours from the lockdown era.”

James Smith, managing director, The Kite Factory, highlighted UK adspend’s record growth and the online boom is “peppered with caution and caveats”.

He pointed to platforms like TikTok hitting a billion global users faster than any other social platform in history, alongside less heralded ones like Reddit and Twitch which are yet to “show their full potential”.

“It is the unfolding online figures that standout,” Smith said. “Online and search is up significantly and looks set to continue into 2023.”

He added: “Data targeting and measurable value are changing the way agencies can support our clients with their brand advertising. This is a genuinely new era, where we can embrace multiple platforms and prove engagement to help brands build in the longer-term in media that were once only considered in the short-term.”

Online investment strong, but do not forget about TV and OOH

Richard Kelly, UK chief revenue officer of WPP media agency Mindshare, also pointed to investment in online formats, adding: “We’re seeing investment in online formats continue to flourish and further establish its influence in reaching once untapped audiences. The idea of the metaverse has sparked many interesting conversations surrounding the future of advertising and we expect to see digital formats continue to dominate as brands move away from more traditional advertising and begin to dip their toes into new uncharted territory.”

In traditional media, Kelly said TV was outperforming expectations.

He commented: “Excitement surrounding the future of TV has been reignited as opportunities continue to develop and diversify, as exemplified by Netflix announcing the integration of ads onto the platform. This means it’s certainly going to be an exciting year for the space, as the arms race between live and on-demand TV rages on without an end in sight.”

Charlotte Taylor, head of publishing and audio at Publicis agency Spark Foundry, noted there was a return in advertiser confidence among brands associated with “bigger ticket items”.

She said: “Q1 this year has seen the continued return of brands from sectors that were particularly hit by the pandemic, namely travel and motors. What has been most hopeful to see is advertisers’ investment in channels that suffered the majority of the budget cuts, witness continued growth in spend.

“Media channels that have traditionally been more “offline based” now have brilliant capability to play in this space with their continued investment in; technology, automation and data optimisation, making them more adaptable, smarter and faster,” Taylor added.

Regarding adspend in the out-of-home market, Ali MacCallum, CEO, Kinetic UK, said: “The expected 2022 forecast of a +31.5% YoY change certainly reflects what we are feeling on the ground. Brands recognise that out of home audiences are back in full force, and it’s no surprise they’re turning to a combination of classic and digital OOH inventory to target existing and future customers.”

MacCallum said in Kinetic UK’s recent Mobile Pound research, it found UK adults spend £179bn a year via mobile devices while out of home, which he said was “greater evidence of the power of OOH to drive online and physical sales”.

He added: “OOH consistently provides tangible value to brands and with the continued regulation and decline of previously effective online advertising strategies, we are feeling ever-more optimistic about the future of OOH. We expect this upward trend to continue as brands build familiarity to get through the potentially hard times ahead as cost-of-living rises. We are glad to see this optimism reflected in the report this quarter.”

What’s next?

Despite economic uncertainty looking forward, agency sources said there were many opportunities in 2022 including the Qatar World Cup in Q4 this year and developments in attention measurement and precision targeting.

The UK ad market is forecasted to show a growth of 10.7% for 2022, which Taylor said was due to a blend of advertiser confidence continuing to return and post-covid market adjustments seen across many media channels.

Clare Dove, UK group commercial director at Future said: “The cost of living crisis is ushering in an extended period of uncertainty for consumers, so it is vital that publishers provide them with high quality, verified and trusted information to help them navigate the changing economic environment.”

Dove said making use of editorial experts to deliver the most relevant insights for readers and advertisers would not only help navigate soaring market costs but also allow brands to reach consumers in “the most valuable spaces”.

As an example, she pointed to knowledge around consumers’ ecommerce purchases indicating current needs and passions, which can be leveraged in real-time.

She said: “In-house experts can check deals every 10-20 minutes, and publishers, keeping a close eye on consumer purchasing trends, can adjust their articles in response — a practice that will also mean the best performing products can be given standalone spotlights on websites and within editorial content.”

The Advertising Association/WARC quarterly Expenditure Report has detailed advertising expenditure in the UK with data and forecasts for different media going back to 1982.