How the VOD giants are navigating the cost of living crisis

Netflix’s recent crackdown on sharing log-ins is now in effect, and with 238 million paid subscribers worldwide as of Q2 2023, it’s keen to ensure that just those households who are paying have access.

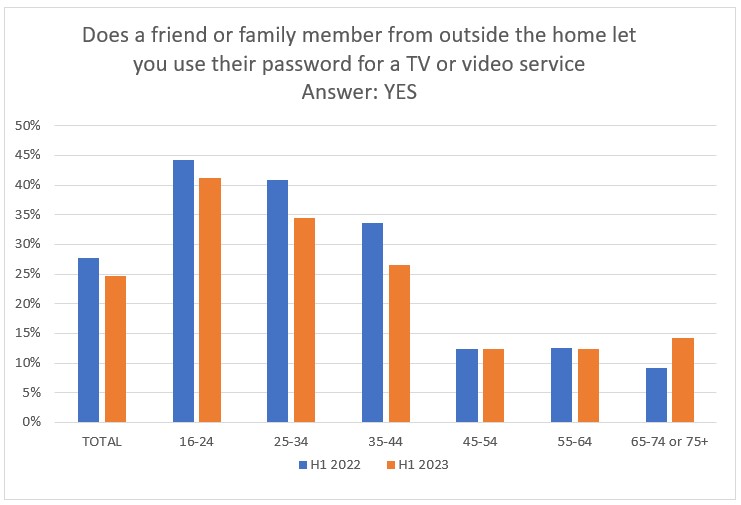

Within the exclusive Connected Screens survey Adwanted runs for the media industry, we ask questions on whether passwords have been shared or borrowed.

Looking at year-on-year borrowing, numbers have dropped for most age ranges, particularly for 25-34s and 35-44s, so it appears that Netflix’s action is starting to have an effect.

Subscribers to Adwanted’s Mediatel Connected data product can see whether a similar pattern can be seen for those who share their log-ins.

Announced at its recent quarterly financial earnings meeting, Netflix has dropped its cheapest ad-free plan, with the company now only offering the £4.99 monthly ad-supported tier, the £10.99 monthly standard plan or the £15.99 monthly premium plan.

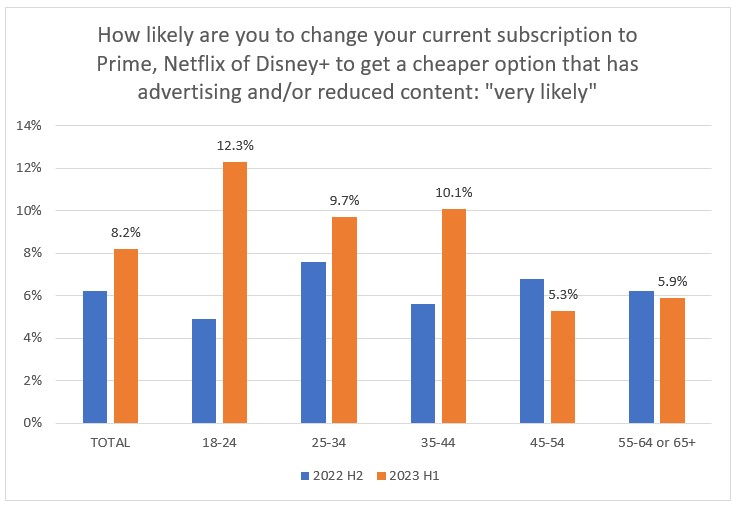

Interestingly, in the latest exclusive YouGov Video & Voice research released recently into Mediatel Connected, we can see how likely the respondents may wish to change their current Prime, Netflix or Disney+ subscriptions to get a cheaper option that has advertising and/or reduced content.

For those who had existing VOD subscriptions there was a resounding shift in all age groups under-45 period-on-period that said they were “very likely” to change to a cheaper or reduced content option.

Further insights are available within the Consumer Surveys app in The Media Leader‘s sister data product, Mediatel Connected, around the likelihood of taking out new subscriptions to these cheaper ad-funded or reduced content services, as well as to explore possibility of cancelling.

Advertising revenue from these ad-funded VOD services is forecast to grow enormously over the next few years with Digital TV Research forecasting that Disney+ will reach more than $11bn in annual advertising revenue within five years, which is more than Netflix and YouTube combined.

The current cost of living crisis in the UK is certainly making people review their expenses, with households cutting back and changing options where possible. With password restrictions in place and ad-funded options available, it will be interesting to see how the customer make-up of the established VOD services changes over the next few years from SVOD to potentially AVOD.

Anne Tucker is head of research at Mediatel Connected, under Adwanted Group, which publishes The Media Leader.

Anne Tucker is head of research at Mediatel Connected, under Adwanted Group, which publishes The Media Leader.

The award-winning Consumer Surveys app within Mediatel Connected carries industry leading research covering all media, from RAJAR, Barb, Ofcom, TouchPoints and exclusive surveys Video & Voice from YouGov, and Adwanted UK’s exclusive Connected Screens tracker survey.

To find out more about the Mediatel Connected data product, please get in contact at clientservices@uk.adwanted.com.