Broadcast TV’s decline worsens in UK as streaming subscribers fall too

The pandemic is well and truly over when it comes to impacting the UK’s media habits, as both broadcast TV viewing and streaming subscriptions have reversed after the Covid lockdown boom of 2020 and 2021.

Broadcast TV’s weekly audience reach has suffered the steepest annual decline since records began, with older audiences daily viewing falling at the fastest rate ever, Ofcom’s yearly report into UK media habits has revealed.

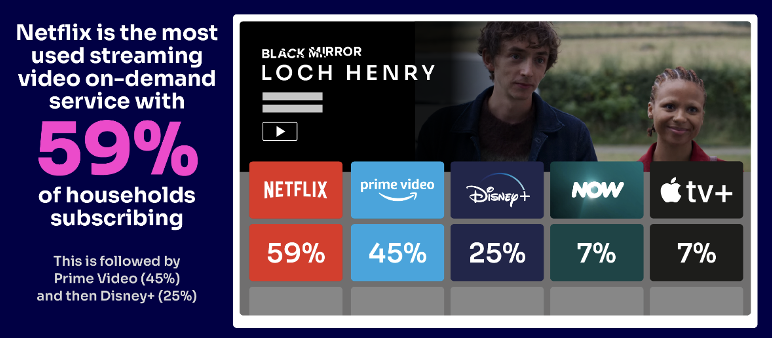

Meanwhile, the number of UK households using a subscription video-on-demand (SVOD) service has fallen to 66% in the first three months of this year, down from a peak of 68% in Q1 2022.

This year’s Media Nations report suggests that the decline in traditional media behaviours is not just continuing to fall, but drop ever more precipitously as different generations transition from offline to online media channels.

The broadcast regulator’s report is a summary of different data sources for UK media consumption in 2022. Here is a snapshot of report’s findings.

TV

The proportion of viewers who tune in to traditional broadcast TV each week has seen the sharpest ever annual fall — from 83% in 2021 to 79% in 2022.

BBC One remains the only channel to reach more than half of the viewing population every week.

Viewers spent 2 hours 38 minutes watching broadcast TV each day in 2022 — down 12% year on year.

However, for the first time, there is evidence of a significant decline in average daily broadcast TV viewing among ‘core’ older audiences (aged 65+) — a drop of 10% year on year, and down 6% on pre-pandemic levels.

Meanwhile, older viewers appear to be diversifying their viewing and more likely to take up streaming services. The proportion of over-64s subscribing to Disney+, for example, increased from 7% in 2022 to 12% in 2023.

However, overall household take-up of these services overall appears to be plateauing, suggesting the subscription video-on-demand (SVOD) market is approaching a saturation point. Two-thirds (66%) of UK households reported using a subscription video-on-demand service in Q1 2023, down from a peak of 68% in Q1 2022.

Netflix has also become the third-most popular destination for viewers when they turn on their TV, although this is still a small minority of people (6%). BBC One (20%) and ITV1 are still the top two first destinations.

The number of TV programmes pulling in more than 4 million viewers has halved since 2014 to 1,184 last year. The number of programmes with large audiences is down across all genres. However, that’s still a lot when compared to streaming platforms: only 48 programmes averaged more than 4 million TV viewers on streaming platforms in 2022, with Netflix accounting for the vast majority.

There was an even sharper drop (82%) in the number of broadcast transmissions generating more than six million TV viewers, from 1,172 in 2014 to 213 in 2022.

These declines are a reflection of fewer people watching the main early- and late-evening TV news bulletins, as well as a steady decline in viewing figures for the UK’s three most popular TV soaps: Coronation Street (ITV1), EastEnders (BBC One)and Emmerdale (ITV1). Since 2014, news programmes attracting more than 4 million viewers are down 72%, while mass audience soap episodes are down 42%.

However, watching broadcasters’ content (either live, on recorded playback or streamed on-demand) still accounts for the greatest proportion of all time spent each day watching TV and video (60%, which is 2 hours 41 minutes per person, per day).

Meanwhile, the big broadcasters video-on-demand (BVOD) services show strong growth: ITVX accounted for 10% of ITV’s total viewing in the first half of 2023 (up from 7% across 2022), while BBC iPlayer rose from 14% of the BBC’s total viewing to 18% during the same time period.

Matt Hill, research and planning director at commercial TV marketing body Thinkbox, said the figures showed how UK broadcasters “remain the bedrock of the nation’s media consumption”.

“The rebalancing between live and on-demand viewing has been happening for over a decade as people of all ages change how they watch TV,” Hill said. “But what’s clear is that the broadcasters’ pedigree and expertise in what UK viewers enjoy means they are well placed to thrive in the future.”

Social media

The latest available data suggests that teenagers and young adults are now spending nearly an hour per day on short-form content app TikTok (an average of 58 minutes), but Snapchat is also very popular with people aged 15-24 (average of 52 minutes), as is YouTube (48 minutes) and Instagram (25 minutes).

The data shows that short-form video content lasting less than 10 minutes is particularly popular, over two-thirds (68%) of 15-24s claiming to watch short-from videos daily (YouTube being the most popular destination).

Radio

As today’s Rajar radio audience figures confirm, Ofcom data show commercial radio is consolidating its lead over the BBC in the UK. Today’s figures from Ofcom are already out of date: it quotes commercial radio having a 51% market share as of the first quarter of 2023; today’s second-quarter Rajar figures reveal this share is significantly bigger at 54.5%.

Nevertheless, live radio continues to reach the vast majority of adults, with 88% of people tuning in for an average of 20 hours each week across digital, analogue and online platforms. Smart speakers now account for 20% of in-home radio listening, while 21% of adults’ audio listening is to streamed music (which increases to 50% among 15-34s).

Around one in five adults (20%) listen to podcasts each week, with the increase largely driven by listeners aged 25-44. Older teens and younger adults, however, appear to be turning away from podcasts, with weekly listening among 15-24s falling to just under 22% (as of the first quarter of 2023).

Yih-Choung Teh, group director, strategy and research at Ofcom, described viewers and listeners of having an “all-you-can-eat” buffet of broadcasting and online content to choose from and that media owners’ competition for their attention has never been more fierce.

He said: “Our traditional broadcasters are seeing steep declines in viewing to their scheduled, live programmes — including among typically loyal older audiences — and soaps and news programmes don’t have the mass-audience pulling power they once had.

“But despite this, public service broadcasters are still unrivalled in bringing the nation together at important cultural and sporting moments, while their on-demand players are seeing positive growth as they digitalise their services to meet audience needs.”