Disney’s $1.5bn investment in Epic Games a ‘statement of intent’

Disney has announced its intention to invest $1.5bn in Fortnite developer Epic Games.

The investment, subject to closing conditions and regulatory approval, would give Disney an equity stake in the gaming company. It forms a multi-year project that aims to create “an all-new games and entertainment universe”. Lego, Sony and Tencent are the other equity partners in Epic Games.

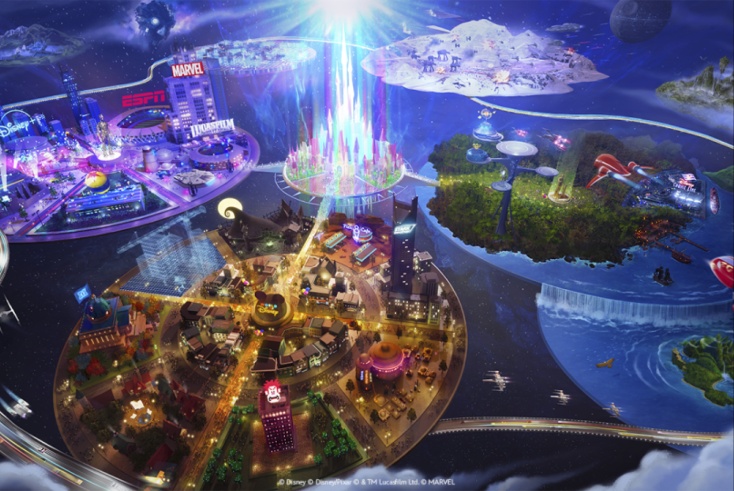

This universe would interoperate with Fortnite and “offer a multitude of opportunities for consumers to play, watch, shop and engage with content, characters and stories from Disney, Pixar, Marvel, Star Wars, Avatar and more”.

Bob Iger, Disney’s CEO, said: “This marks Disney’s biggest entry ever into the world of games and offers significant opportunities for growth and expansion. We can’t wait for fans to experience the Disney stories and worlds they love in groundbreaking new ways.”

Analysis: An evolution of a partnership

Disney and Epic Games have a long-standing partnership with multiple tie-ups. Together, they have reached hundreds of millions of players through Fortnite content integrations, season collaborations, in-game activations and live events.

Epic Games also participated in the 2017 Disney Accelerator programme.

Tim Sweeny, CEO and founder of Epic Games, said in statement: “Disney was one of the first companies to believe in the potential of bringing their worlds together with ours in Fortnite and they use Unreal Engine across their portfolio. Now we’re collaborating on something entirely new to build a persistent, open and interoperable ecosystem that will bring together the Disney and Fortnite communities.”

Despite their history, $1.5bn is still “a significant figure”, according to Matthew Day, global gaming strategy director at EssenceMediacom’s specialist Play division, even if it is less than the $4bn Disney paid for Marvel and Lucasfilm intellectual property (IP).

Day told The Media Leader: “Epic’s revenue for 2023 was around $5bn, so proportionally this is a pretty sizeable investment in the platform. Recent games industry mergers and acquisitions like the Activision Blizzard merger with [Microsoft] Xbox are obviously much larger sums, but that’s for full acquisition of IP and studios. This investment is a softer partnership that is clearly an evolution of the long-running collaboration between Fortnite and Disney brands.”

Cross-play space

Shay Thompson, a broadcaster covering the gaming industry, pointed to recent rumours that Xbox would be taking its exclusive first-party titles to other consoles like Sony PlayStation, allowing more people on different platforms to play together.

“It will be interesting to see how Disney and Fortnite will be looking into that cross-play space,” she explained. “They could be going more the angle of having as many games and experiences available to even more players around the world.”

Thompson described the opening up of games as “a positive move”, as long as it did not “stifle creativity”.

She added: “There’s no point in having access to these games if they’re not good and if they’re not creative — if they’re just hollow husks that are money-making machines.”

Financial commitment

Another option for Disney would be to tap into live service games, which are supported for a long time, Thompson suggested. This “makes the most sense” given the titles within Disney’s portfolio, she added, although these games are “not as financially viable” since they require expensive upkeep.

Thompson explained that “AAA games” — those from a mid-sized or major publisher with higher development and marketing budgets — could cost $30-80m or even as high as $300m to create, not including advertising costs, with the average development cycle at three to five years.

And although there seems to be big money floating around gaming at the moment, there have been 6,000-7,000 lay-offs across the industry globally in the first two months of the year, she stressed.

Thompson added: “It is a partnership that makes sense, especially in the long term. It’s just there’s maybe a bit of fatigue around announcements like this, as we just watched the entire situation with Activision and Microsoft all of last year. And for people that have more leftist sensitivities like me, it’s another capitalistic monopoly joining forces.”

Metaverse strategy

While Thompson remarked that the metaverse has been “notably absent” from Disney’s press release, Day had another theory.

He said: “When Disney shuttered their ‘metaverse division’, many saw it as a sign of them pivoting away from that area. But I think this investment shows that actually they were pivoting to a different strategy of partnering with one of most successful ‘metaverse’ platforms there is, which is Fortnite.

“A ‘multitude of opportunities for consumers to play, watch, shop and engage with content, characters and stories’ stops just short of using the word ‘metaverse’, but clearly the ambition is the same and that is clearly still a key part of Disney’s future strategy.”

Day added that Disney’s relationship with gaming has “never been hands off”, with many of its characters featuring in games. With Marvel and Star Wars in its stable, that effort is likely to be “even more pronounced”. But Disney’s investment is “a more direct statement of intent” to “create a destination of their own, within a huge gaming platform”, he said.

What does this mean for advertisers?

Nick Wright, chief growth officer at Havas Media Network UK, told The Media Leader this tie-up reflects consumers’ more connected experiences.

He explained: “Entertainment is IP brought to life through a series of varied yet connected experiences. Consumers don’t see these as siloed — I’m a film fan, I’m a gamer — and Disney’s tie-up with Epic Games is reflecting the need and ability to engage with consumers by adapting narratives across multiple touchpoints from the ‘lean back’ nature of film to the ‘lean in’ nature of gaming.

“This is a win-win from a brand and consumer point of view. Consumers get a deeper and broader experience of the things they love; brands get to ‘sweat the assets’ more than ever before to increase profitability and their engagement with their fans.”

Day said “the possibilities are really endless” when looking at opportunities for advertisers and the question will be how accessible the advertising vehicle is and how the offer matures over time.

He explained: “Brands, certainly the ones that are already looking at gaming and gaming audiences, will be very interested to hear what, if any, opportunities there will be in future. And those that already have business relationships with Disney will likely be the first we see starting to take advantage.”

However, for gamers, the reception has been “less clear-cut”.

Day continued: “The Fortnite audience specifically has shown repeatedly how they love the social aspects of the platform and non-gaming ‘events’ like music concerts and trailer debuts that have happened there, so I have no doubt Disney’s offering will have a huge audience from the strength of that existing Fortnite user base.

“But the mass gaming audience is much bigger than Fortnite alone and it will be down to the strength of the content that Disney populate their ‘persistent universe’ with to pull in new users. With the strength of Disney’s IP portfolio, the odds are in their favour.”